Understand NRI inheritance laws in India: learn about property types, tax implications, and repatriation rules for NRIs inheriting property in India.

Introduction

- Brief overview of NRI inheritance laws in India

- Importance of understanding these laws

Understanding Inheritance in India

- Definition of inheritance and succession

- Types of succession: Testamentary and Intestate

Who Can Inherit Property?

- NRIs, OCIs, and foreign citizens

Laws Governing Inheritance

- Hindu Succession Act

- Indian Succession Act

- Muslim Personal Law

Types of Property NRIs Can Inherit

- Residential

- Commercial

- Agricultural

Registration of Inherited Property

- Necessary documents

- Registration process

Documentation for Inheritance

- Inheritance through a Will

- Inheritance through intestate succession

Role of Power of Attorney

- When and how to use it

Options After Inheriting Property

- Retaining the property

- Selling the property

- Renting out the property

Selling Inherited Property

- Eligible buyers

- Necessary documents

Tax Implications

- Income tax on rental income

- Capital gains tax

Calculating Capital Gains Tax

- Short-term vs. long-term capital assets

- Cost of acquisition and improvement

- Fair market value adjustment

Saving on Capital Gains Tax

- Investment in residential property

- Approved bonds and capital gains exemption schemes

Repatriation of Sale Proceeds

- Conditions for repatriation

- Bank requirements

- RBI approval

Conclusion

- Summary of key points

- Final advice for NRIs

FAQs

Understanding Property Succession and Tax Implications

Introduction

Navigating the NRI inheritance laws for NRIs (Non-Resident Indians) in India can be complex, but understanding these regulations is crucial for ensuring a smooth transfer of assets. This guide will walk you through the key aspects of NRI inheritance laws in India, focusing on real estate, and provide practical insights into handling your inherited property.

Understanding Inheritance in India

Inheritance, or succession, is the process by which the assets of a deceased person are transferred to their heirs. This process ensures that the property and other possessions of the deceased are distributed according to their wishes (if a Will exists) or according to legal guidelines (if no Will exists).

Types of Succession: Testamentary and Intestate

Testamentary Succession

Testamentary succession occurs when the deceased has left a valid Will. A Will is a legal document that outlines how the deceased’s property should be distributed among the beneficiaries. This type of succession is guided by the instructions specified in the Will. The executor, appointed in the Will, is responsible for ensuring that the assets are distributed as per the deceased’s wishes. The process might involve obtaining a probate, which is a legal certification of the Will’s authenticity.

Intestate Succession

Intestate succession happens when a person dies without leaving a valid Will. In this case, the distribution of the deceased’s assets is governed by the succession laws applicable to their community or religion. For example, the Hindu Succession Act, 1956, applies to Hindus, Sikhs, Jains, and Buddhists, while the Indian Succession Act governs Christians and Parsis. Muslim personal laws govern the inheritance for Muslims. These laws define the legal heirs and the order in which they will inherit the deceased’s property.

Who Can Inherit Property?

When it comes to inheriting property in India, various categories of individuals are eligible, including Non-Resident Indians (NRIs), Overseas Citizens of India (OCIs), and foreign citizens. Here’s a closer look at each of these categories:

NRIs (Non-Resident Indians)

NRIs are Indian citizens who reside outside India for employment, business, or other purposes that indicate an intention to stay outside India for an uncertain duration. NRIs can inherit property from a resident Indian or another NRI, provided the property was acquired in accordance with NRI inheritance laws , particularly the foreign exchange regulations in force at the time of acquisition.

OCIs (Overseas Citizens of India)

OCIs are individuals of Indian origin who have taken citizenship of another country but hold an OCI card, which allows them various rights and privileges in India. OCIs have the same inheritance rights as NRIs and can inherit property from Indian residents or other NRIs/OCIs under similar conditions.

Foreign Citizens

Foreign citizens, who do not hold Indian citizenship or an OCI card, can also inherit property in India. However, the process is subject to more stringent regulations. The inheritance must comply with the provisions of the Foreign Exchange Management Act (FEMA), ensuring that the property was lawfully acquired by the deceased. Additionally, foreign citizens must adhere to specific repatriation rules if they intend to transfer the sale proceeds of inherited property out of India.

In summary, NRIs, OCIs, and foreign citizens can inherit property in India, but they must navigate different legal frameworks and regulations to ensure the inheritance process is compliant with Indian laws.

Laws Governing Inheritance

Inheritance laws in India are complex and vary based on the religion and community of the deceased. Here’s an overview of the primary laws that govern inheritance in India:

Hindu Succession Act

The Hindu Succession Act, 1956, applies to Hindus, Buddhists, Jains, and Sikhs. This act governs the inheritance of property for individuals who belong to these communities. The law differentiates between male and female heirs and specifies the order of succession for both.

- For Male Hindus: The property of a deceased male Hindu who dies intestate (without a Will) is distributed among his Class I heirs, which include his sons, daughters, widow, mother, and specified other relatives. If there are no Class I heirs, the property goes to Class II heirs, followed by agnates and then cognates.

- For Female Hindus: The property of a deceased female Hindu who dies intestate is first distributed to her children and husband. If there are no such heirs, it is distributed to her husband’s heirs, her parents, and finally to her father’s heirs.

Indian Succession Act

The Indian Succession Act, 1925, primarily governs the inheritance of property for Christians and Parsis in India. This act provides detailed guidelines on the distribution of the deceased’s estate based on whether they have left a Will (testamentary succession) or not (intestate succession).

- Testamentary Succession: If the deceased has left a valid Will, the property is distributed according to the instructions in the Will.

- Intestate Succession: If the deceased has not left a Will, the property is distributed according to a prescribed order of succession. For instance, for Christians, the spouse and children are primary heirs, followed by other relatives in a specified order.

Muslim Personal Law

Inheritance for Muslims in India is governed by Muslim Personal Law, primarily derived from the Quran and the Hadith. The principles of inheritance under Muslim law are quite distinct and are based on pre-determined shares for specific relatives.

- Sunni Law: The Sunni Muslim law of inheritance allocates fixed shares to heirs, such as the spouse, children, parents, and other specified relatives. The remaining property, if any, is distributed among the residuary heirs.

- Shia Law: The Shia Muslim law of inheritance also specifies fixed shares for certain heirs, but the distribution among residuary heirs can differ from Sunni law.

These laws ensure that the inheritance process aligns with the religious and cultural practices of the deceased’s community, providing a structured approach to the distribution of assets.

Types of Property NRIs Can Inherit

NRIs (Non-Resident Indians) have the legal right to inherit various types of property in India, each governed by specific regulations and guidelines. Here’s a detailed look at the types of property NRIs can inherit:

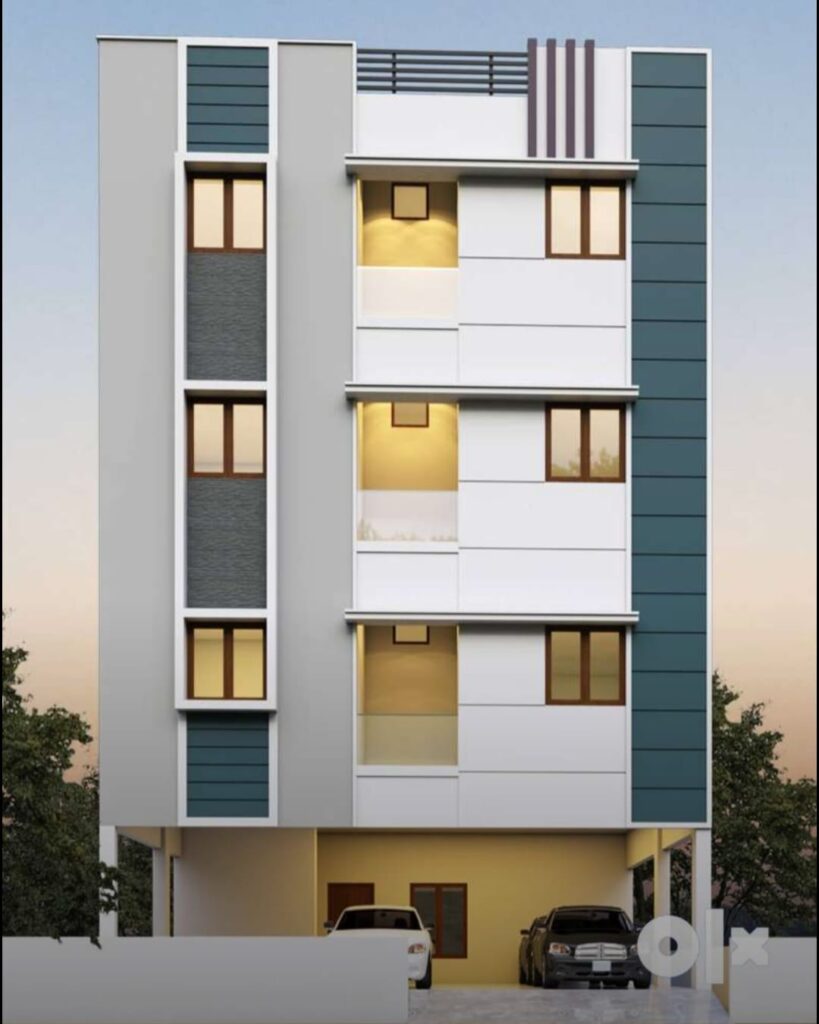

1. Residential Property

NRIs can inherit residential properties, including houses, flats, and apartments. There are no restrictions on the number or type of residential properties that an NRI can inherit. This category encompasses:

- Urban Residential Properties: These include houses, apartments, and flats in cities and towns across India.

- Rural Residential Properties: Properties in rural areas, such as farmhouses and bungalows, are also included.

2. Commercial Property

Commercial properties are another category that NRIs can inherit. These include properties used for business purposes, such as office buildings, retail spaces, and industrial units. NRIs can inherit:

- Office Buildings: Commercial spaces used for business operations.

- Retail Spaces: Shops and commercial outlets located in various markets or shopping complexes.

- Industrial Units: Factories and warehouses used for manufacturing and storage.

3. Agricultural Land

The inheritance of agricultural land by NRIs is subject to specific regulations and restrictions. As per the current laws, NRIs can inherit agricultural land, but they must comply with the following conditions:

- Restrictions under State Laws: Different states have different regulations regarding the inheritance of agricultural land by NRIs. For example, states like Punjab, Haryana, and Madhya Pradesh have restrictions on the ownership of agricultural land by NRIs.

- Approval from Relevant Authorities: In some states, NRIs may need to seek approval from the state government or local authorities before inheriting agricultural land.

4. Farmhouses

Farmhouses are considered a subset of agricultural land and can be inherited by NRIs, provided they meet the specific criteria set by the state regulations. Farmhouses typically include properties with a combination of residential and agricultural land use.

In summary, NRIs can inherit a wide range of properties in India, including residential, commercial, agricultural, and farmhouses. However, they must be aware of and comply with the relevant legal requirements and state-specific regulations to ensure a smooth inheritance process.

Registration of Inherited Property

In India, registering inherited property involves several steps and the submission of specific documents to ensure legal ownership transfer. Here’s a detailed guide on the necessary documents and the registration process:

Necessary Documents

- Death Certificate of the Deceased: A certified copy of the death certificate of the deceased property owner is essential to initiate the inheritance process.

- Identification Documents:

- Passport Copy: A copy of the passport of the deceased and the inheritor (NRI).

- Permanent Account Number (PAN) Card: PAN card copies of both the deceased and the inheritor.

- Birth Certificate: Birth certificate of the deceased and the inheritor to establish the relationship.

- Will (if applicable):

- If the property was inherited through a Will, a copy of the Will along with the probate (if available) is required.

- Property Documents:

- Original property documents such as sale deed, conveyance deed, or allotment letter.

- Any other relevant documents related to the property’s acquisition and ownership.

- Succession Certificate or Legal Heir Certificate (if applicable):

- If there is no Will, a succession certificate obtained from the District Court or a legal heir certificate may be required.

- No Objection Certificate (NOC):

- If the property is mortgaged, a NOC from the financier or bank stating that they have no objection to the transfer of ownership.

- Other Documents:

- Depending on state-specific requirements, additional documents such as affidavits, indemnity bonds, or clearance certificates may be necessary.

Registration Process

- Prepare Documents: Gather all necessary documents mentioned above.

- Visit Sub-Registrar Office:

- The inheritor (or their authorized representative) must visit the sub-registrar office within whose jurisdiction the property is located.

- Submit Documents:

- Submit the complete set of documents along with the application for property registration.

- Verification and Processing:

- The sub-registrar office will verify the documents and process the application for registration.

- Payment of Fees:

- Pay the registration fees and stamp duty charges as per the applicable rates. These charges vary depending on the state and the value of the property.

- Execution of Registration:

- Once the documents are verified and fees paid, the registration of the property will be executed in the presence of the sub-registrar.

- Issuance of Registration Certificate:

- After completion of the registration process, a registration certificate confirming the transfer of ownership will be issued to the inheritor.

- Update Revenue Records:

- Ensure that the updated ownership details are reflected in the revenue records maintained by the local authorities.

By following these steps and ensuring compliance with all legal requirements, NRIs can successfully register their inherited property in India, facilitating secure ownership and future transactions.

Documentation for Inheritance

In India, inheriting property involves specific documentation depending on whether the inheritance occurs through a Will or intestate succession (without a Will). Here’s a detailed outline of the documentation required for each scenario:

Inheritance through a Will

When property is inherited through a Will, the following documents are typically required:

- Death Certificate of the Deceased: A certified copy of the death certificate of the deceased property owner.

- Identification Documents:

- Passport Copy: Copies of the passport of the deceased and the inheritor (NRI).

- Permanent Account Number (PAN) Card: PAN card copies of both the deceased and the inheritor.

- Birth Certificate: Birth certificate of the deceased and the inheritor to establish the relationship.

- Original Will: A certified copy of the original Will signed by the deceased. The Will must clearly outline the distribution of property among the beneficiaries.

- Probate Certificate:

- If the Will is probated, a probate certificate issued by the competent court confirming the authenticity of the Will and the authority of the executor.

- Property Documents:

- Original property documents such as sale deed, conveyance deed, or allotment letter.

- Any other relevant documents related to the property’s acquisition and ownership.

- No Objection Certificate (NOC):

- If the property is mortgaged, a NOC from the financier or bank stating no objection to the transfer of ownership.

- Other Documents:

- Depending on state-specific requirements, additional documents such as affidavits, indemnity bonds, or clearance certificates may be necessary.

Inheritance through Intestate Succession

When property is inherited without a Will (intestate succession), the following documents are typically required:

- Death Certificate of the Deceased: A certified copy of the death certificate of the deceased property owner.

- Identification Documents:

- Passport Copy: Copies of the passport of the deceased and the inheritor (NRI).

- Permanent Account Number (PAN) Card: PAN card copies of both the deceased and the inheritor.

- Birth Certificate: Birth certificate of the deceased and the inheritor to establish the relationship.

- Succession Certificate:

- A succession certificate issued by the District Court confirming the legal heirs entitled to inherit the deceased’s property as per applicable laws.

- Property Documents:

- Original property documents such as sale deed, conveyance deed, or allotment letter.

- Any other relevant documents related to the property’s acquisition and ownership.

- No Objection Certificate (NOC):

- If the property is mortgaged, a NOC from the financier or bank stating no objection to the transfer of ownership.

- Other Documents:

- Depending on state-specific requirements, additional documents such as affidavits, indemnity bonds, or clearance certificates may be necessary.

By ensuring the proper preparation and submission of these documents, NRIs can effectively navigate the inheritance process in India, ensuring compliance with legal requirements and facilitating the smooth transfer of property ownership.

Role of Power of Attorney

A Power of Attorney (PoA) is a legal document that grants someone the authority to act on behalf of another person in specified matters. For NRIs inheriting property in India, understanding the role of PoA is crucial:

When to Use Power of Attorney

- Execution of Legal Documents: NRIs who cannot be physically present in India for the inheritance process can execute a PoA in favor of a trusted person. This authorized individual, known as the attorney-in-fact or agent, can handle legal formalities on behalf of the NRI.

- Property Transactions: PoA can be used to facilitate various property transactions, including registration, sale, or leasing of inherited property. It empowers the agent to sign documents, attend registration processes, and execute agreements related to the property.

- Management of Affairs: In situations where the NRI needs ongoing management of their property in India, such as handling rental agreements, property maintenance, or financial transactions, PoA enables the appointed agent to manage these affairs efficiently.

How to Use Power of Attorney

- Drafting the PoA: The PoA document should clearly outline the powers granted to the agent. It should specify the purpose (e.g., property inheritance), duration (whether it’s specific or general PoA), and limitations, if any.

- Notarization and Attestation: The PoA must be signed by the NRI in the presence of a notary public or an authorized official. If executed outside India, it may require attestation by an Indian embassy or consulate.

- Specificity and Clarity: Ensure that the PoA is specific and tailored to the intended purpose. Clearly define the scope of authority granted to the agent and include details such as property addresses, transaction specifics, and any restrictions.

- Revocation: The NRI retains the right to revoke or modify the PoA at any time, provided they are mentally competent to do so. Any revocation should be communicated formally to the agent and relevant authorities.

- Recording and Filing: Once executed, the PoA should be recorded or filed with the appropriate authorities in India, such as the sub-registrar office handling property transactions, to ensure its validity and enforceability.

Using a Power of Attorney can significantly simplify and expedite the process of managing inherited property for NRIs, offering flexibility and legal compliance in their absence from India. It is advisable to consult with legal professionals to draft and execute PoA in accordance with applicable laws and regulations.

Options After Inheriting Property

Upon inheriting property in India, NRIs have several options to consider based on their objectives and circumstances:

1. Retaining the Property

NRIs may choose to retain the inherited property for personal use or as an investment. Retaining the property allows them to maintain ownership and potentially benefit from long-term appreciation in property value. It can also serve as a residence during visits to India or as a vacation home.

2. Selling the Property

Selling the inherited property is an option for NRIs looking to liquidate their asset. This may be desirable if the NRI prefers to convert the property into cash for other investments or financial needs. Before selling, NRIs should consider factors such as market conditions, property valuation, capital gains tax implications, and compliance with local regulations.

3. Renting Out the Property

NRIs can choose to rent out the inherited property to generate rental income. Renting out the property can provide a steady stream of income and help cover maintenance costs and property taxes. It also allows NRIs to retain ownership while benefiting from rental yields.

Considerations

- Legal and Tax Implications: Each option—retaining, selling, or renting—has legal and tax implications that NRIs must understand and comply with. For instance, capital gains tax may apply on the sale of property, while rental income is subject to income tax in India.

- Market Conditions: Market conditions, rental demand, and property prices should be evaluated before making a decision. Factors such as location, amenities, and economic trends can influence the viability of each option.

- Property Management: If renting out the property, NRIs should consider property management services to handle tenant relations, maintenance issues, and regulatory compliance on their behalf.

By carefully weighing these options and seeking professional advice from legal and financial experts, NRIs can make informed decisions about how to manage their inherited property in India effectively. Each option offers unique benefits and considerations, tailored to the NRI’s financial goals and personal preferences.

Selling Inherited Property

When an NRI decides to sell inherited property in India, certain considerations regarding eligible buyers and necessary documents must be taken into account:

Eligible Buyers

- Indian Residents: Any individual who is a citizen of India and resides within the country can purchase inherited property from an NRI.

- Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs): NRIs and OCIs are also eligible to buy inherited property from another NRI. However, there are restrictions on purchasing agricultural land, plantation property, or farmhouse property, which require specific permissions and adherence to regulatory guidelines.

- Foreign Citizens: Foreign nationals or citizens of other countries can typically purchase inherited property in India subject to compliance with the Foreign Exchange Management Act (FEMA) regulations. They may need to obtain specific approvals from relevant authorities for certain types of properties.

Necessary Documents

- Death Certificate of the Deceased: A certified copy of the death certificate of the deceased property owner.

- Identification Documents:

- Passport Copy: Copies of the passport of the deceased and the inheritor (NRI).

- Permanent Account Number (PAN) Card: PAN card copies of both the deceased and the inheritor.

- Birth Certificate: Birth certificate of the deceased and the inheritor to establish the relationship.

- Property Documents:

- Original property documents such as sale deed, conveyance deed, or allotment letter.

- Any other relevant documents related to the property’s acquisition and ownership.

- No Objection Certificate (NOC):

- If the property is mortgaged, a NOC from the financier or bank stating no objection to the sale of property.

- Tax Clearance Certificate:

- Certificate indicating that all property taxes and dues have been paid up to date.

- Encumbrance Certificate:

- A certificate from the sub-registrar’s office confirming that the property is free from any legal dues or liabilities.

- Agreement to Sell:

- A legally binding agreement between the seller (NRI) and the buyer outlining the terms and conditions of the sale.

- Power of Attorney (if applicable):

- If the NRI cannot attend the sale proceedings in person, a PoA executed in favor of a trusted person to represent them during the transaction.

- Foreign Exchange Declaration Form (if applicable):

- Form required under FEMA regulations to declare the sale proceeds and ensure compliance with foreign exchange laws.

- Other Legal Documents:

- Depending on specific circumstances and state regulations, additional documents such as affidavits, clearance certificates, or approvals may be required.

Before initiating the sale of inherited property, NRIs should ensure they have all necessary documents in order, understand the tax implications, and comply with regulatory requirements to facilitate a smooth and legally compliant transaction. Seeking guidance from legal professionals specializing in property transactions can provide clarity and ensure adherence to all legal formalities.

Tax Implications

When dealing with inherited property in India, Non-Resident Indians (NRIs) should be aware of the following tax implications related to rental income and capital gains:

Income Tax on Rental Income

- Taxable Income: Rental income earned from inherited property in India is taxable under the Income Tax Act, 1961.

- Rate of Tax: The rental income is added to the NRI’s total income and taxed at applicable slab rates. For NRIs, the tax rates are typically higher compared to resident Indians.

- Deductions: NRIs can claim deductions on expenses incurred for maintaining the property, such as property taxes, maintenance charges, repairs, and interest on loans taken for the property.

- Tax Deduction at Source (TDS): If the annual rental income exceeds a specified threshold (currently Rs. 2.5 lakhs per annum), the tenant is required to deduct TDS at a rate of 30% before making the payment to the NRI landlord.

- Filing Income Tax Return: NRIs receiving rental income must file an income tax return in India to report their rental income and claim deductions, if any. It is advisable to consult a tax advisor to ensure compliance with tax regulations.

Capital Gains Tax

- Types of Capital Gains:

- Long-term Capital Gains (LTCG): If the inherited property is held for more than 24 months before sale, any profit generated is considered long-term capital gains.

- Short-term Capital Gains (STCG): If the property is held for 24 months or less, the gains from the sale are considered short-term.

- Tax Rates:

- LTCG: Long-term capital gains on inherited property are taxed at a rate of 20% after indexation.

- STCG: Short-term capital gains on inherited property are taxed at the applicable slab rates for NRIs, which are typically higher than those for resident Indians.

- Indexation Benefit: NRIs can avail the benefit of indexation while calculating long-term capital gains. Indexation adjusts the purchase price of the property based on inflation, reducing the taxable capital gains.

- Exemptions: NRIs can avail exemptions from capital gains tax under certain conditions, such as reinvesting the sale proceeds in specified bonds or residential property within stipulated timelines under Section 54 or Section 54EC of the Income Tax Act.

- Reporting and Compliance: NRIs are required to file their income tax returns in India to report capital gains from the sale of inherited property and claim exemptions, if applicable. Proper documentation and compliance with tax regulations are essential to avoid penalties.

Understanding these tax implications is crucial for NRIs to make informed decisions regarding the management and sale of inherited property in India. Seeking advice from tax professionals can provide personalized guidance based on individual circumstances and ensure adherence to tax laws.

Calculating Capital Gains Tax

Capital gains tax in India varies based on whether the gains are classified as short-term or long-term, the cost of acquisition and improvement, and adjustments for fair market value. Here’s how NRIs can calculate their capital gains tax:

Short-term vs. Long-term Capital Assets

- Short-term Capital Assets:

- Assets held for 24 months or less before sale are classified as short-term capital assets.

- For inherited property, if sold within 24 months of inheritance, the gains are considered short-term.

- Long-term Capital Assets:

- Assets held for more than 24 months before sale are classified as long-term capital assets.

- For inherited property, if sold after 24 months of inheritance, the gains are considered long-term.

Cost of Acquisition and Improvement

- Cost of Acquisition:

- The cost of acquisition for inherited property is the fair market value of the property as on the date of inheritance. This is usually the market value on the date of death of the previous owner.

- Cost of Improvement:

- If any improvements were made to the property after inheritance, the cost of those improvements can be added to the cost of acquisition.

Fair Market Value Adjustment

- Indexation Benefit:

- For long-term capital gains, NRIs can adjust the cost of acquisition and improvement using the Cost Inflation Index (CII) published by the Income Tax Department. Indexation adjusts the purchase price based on inflation, reducing the taxable capital gains.

Calculating Capital Gains

- Short-term Capital Gains (STCG):

- STCG is calculated as the difference between the sale price of the property and the cost of acquisition/improvement. This amount is taxed at the applicable slab rates for NRIs.

- Long-term Capital Gains (LTCG):

- LTCG is calculated as the difference between the sale price and the indexed cost of acquisition/improvement. The indexed cost is calculated by multiplying the original cost by the CII of the year of sale and dividing it by the CII of the year of acquisition/improvement.

- LTCG is taxed at a flat rate of 20% after indexation for NRIs.

Example Calculation:

Suppose an NRI inherited a property valued at Rs. 50 lakhs in 2018 and sold it in 2023 for Rs. 75 lakhs. The indexed cost of acquisition after adjusting for inflation is Rs. 60 lakhs.

- Long-term Capital Gains Calculation:

- Sale Price: Rs. 75 lakhs

- Indexed Cost of Acquisition: Rs. 60 lakhs

- Long-term Capital Gains = Sale Price – Indexed Cost of Acquisition

- Long-term Capital Gains = Rs. 75 lakhs – Rs. 60 lakhs = Rs. 15 lakhs

- Tax Payable on LTCG = Rs. 15 lakhs * 20% = Rs. 3 lakhs

Understanding these calculations helps NRIs effectively manage their tax liabilities when selling inherited property in India. Consulting with a tax advisor can provide further clarity and ensure compliance with tax laws.

Saving on Capital Gains Tax

Non-Resident Indians (NRIs) can potentially save on capital gains tax when selling inherited property in India through specific investment avenues:

1. Investment in Residential Property

NRIs can avail exemptions from long-term capital gains tax under Section 54 of the Income Tax Act by reinvesting the sale proceeds into another residential property. Key points to consider:

- Conditions: The new residential property must be purchased within one year before or two years after the sale date of the inherited property. Alternatively, it can be constructed within three years from the sale date.

- Exemption Amount: The entire capital gains amount or the investment in the new property, whichever is lower, is exempt from tax. If the entire proceeds are reinvested, no capital gains tax is applicable.

- Partial Investment: If the entire capital gains amount is not reinvested, the remaining portion becomes taxable proportionally.

2. Investment in Approved Bonds and Capital Gains Exemption Schemes

NRIs can also avail exemptions under Section 54EC by investing in specified bonds within six months from the sale of inherited property:

- Eligible Bonds: Bonds issued by NHAI (National Highways Authority of India) or REC (Rural Electrification Corporation) with a lock-in period of five years.

- Maximum Investment: Up to Rs. 50 lakhs can be invested in these bonds in a financial year to claim exemption from capital gains tax.

- Tax Benefit: By investing in these bonds, NRIs can defer payment of capital gains tax and effectively reduce their tax liability on the gains from the sale of inherited property.

Considerations

- Compliance: Ensure compliance with all conditions specified under Section 54 and Section 54EC, including timelines for reinvestment and bond purchases.

- Consultation: Seek advice from a tax advisor to understand eligibility, calculation methods, and procedural requirements for availing exemptions.

- Optimization: Plan investments strategically to maximize tax savings while meeting personal financial objectives and timelines.

Utilizing these investment options not only helps NRIs reduce their tax burden but also facilitates prudent financial planning when dealing with inherited property transactions in India.

Repatriation of Sale Proceeds

When NRIs sell inherited property in India, they may repatriate (transfer) the sale proceeds outside India, subject to specific conditions and regulatory requirements:

Conditions for Repatriation

- Mode of Acquisition: The inherited property must have been acquired in compliance with foreign exchange laws prevailing at the time of acquisition. This includes using funds from a Foreign Currency Non-Resident (FCNR) account, Non-Resident External (NRE) account, or through inward remittances in foreign exchange.

- Payment Mode: The sale proceeds should be received through the same channel used for acquiring the property. For instance, if the property was acquired using funds from an NRE account, the sale proceeds must be credited back to the NRE account.

- Limitations on Agricultural Land, Farmhouses: Repatriation of sale proceeds from agricultural land, farmhouses, or plantation properties is restricted. Specific approvals from the Reserve Bank of India (RBI) may be required in such cases.

- Tax Compliance: NRIs must ensure compliance with Indian tax laws, including payment of applicable capital gains tax on the sale of property. Tax clearance certificates may need to be obtained from the Income Tax Department as proof of tax compliance.

Bank Requirements

- Authorized Dealer: Repatriation requests must be made through an authorized dealer (typically a bank) in India. The authorized dealer verifies the compliance of the transaction with RBI guidelines and facilitates the outward remittance of funds.

- Documentation: NRIs are required to submit necessary documents to the authorized dealer, including sale deed, tax clearance certificate, and other proofs of compliance with FEMA regulations.

RBI Approval

- Approval Requirements: In certain cases, such as repatriation exceeding USD 1 million in a financial year or involving agricultural land, RBI approval may be necessary. NRIs must apply through their authorized dealer for RBI approval, providing details of the transaction and reasons for exceeding the prescribed limits.

- Case-by-Case Basis: RBI evaluates each application for repatriation approval on a case-by-case basis, considering factors such as compliance with regulations, source of funds, and purpose of remittance.

Understanding the conditions and procedures for repatriation of sale proceeds is crucial for NRIs selling inherited property in India. Adherence to FEMA regulations, timely submission of required documents, and consultation with financial advisors can facilitate smooth and compliant repatriation of funds, ensuring legal compliance and financial planning objectives are met effectively.

Conclusion

Understanding and navigating NRI inheritance laws in India can be challenging, but with the right knowledge and preparation, you can manage the process efficiently. Ensure you have all necessary documentation, understand the tax implications, and explore your options for the inherited property.

FAQs

- What documents are needed to inherit property as an NRI?

- Death certificate, identification documents, original property documents, and either a valid Will or succession certificate.

- Can NRIs inherit agricultural land in India?

- Yes, NRIs can inherit agricultural land, including farmhouses.

- How is capital gains tax calculated on inherited property?

- By subtracting the cost of acquisition, cost of improvements, and sale-related expenses from the sale proceeds.

- What is the role of Power of Attorney in property inheritance?

- It allows a trusted person to handle inheritance formalities on behalf of the NRI if they cannot be present in India.

- How can an NRI repatriate the sale proceeds of inherited property?

- By fulfilling certain conditions related to the acquisition and payment of the property and potentially seeking RBI approval for amounts over USD 1 million per financial year.

1 thought on “Mastering NRI Inheritance Laws: Comprehensive Guide for Property Succession”